LLC Formations and Consultations Available In-Person, via Video Conference, or Teleconference

LLC Formations for Real Estate Holdings

Strategic, Legal, and Tax-Savvy Structuring for California Properties

At Lucas Real Estate, our attorney-CPA team—Devin R. Lucas, Real Estate Attorney and Broker, and Courtney R. Lucas, Certified Public Accountant—offers comprehensive, high-level guidance on LLC formations tailored specifically for real estate.

Whether you’re considering asset protection, privacy, or long-term estate planning, we help you evaluate whether an LLC is right for your needs—and ensure it’s formed and maintained properly. Consultations are available in-person, via video, or by phone.

Need more information about LLCs – read the highlights below, or explore our more in-depth article on LLCs for real estate holdings here.

Schedule a consultation

info@lucas-real-estate.com | 949-478-1623

Why Hold Real Estate in an LLC?

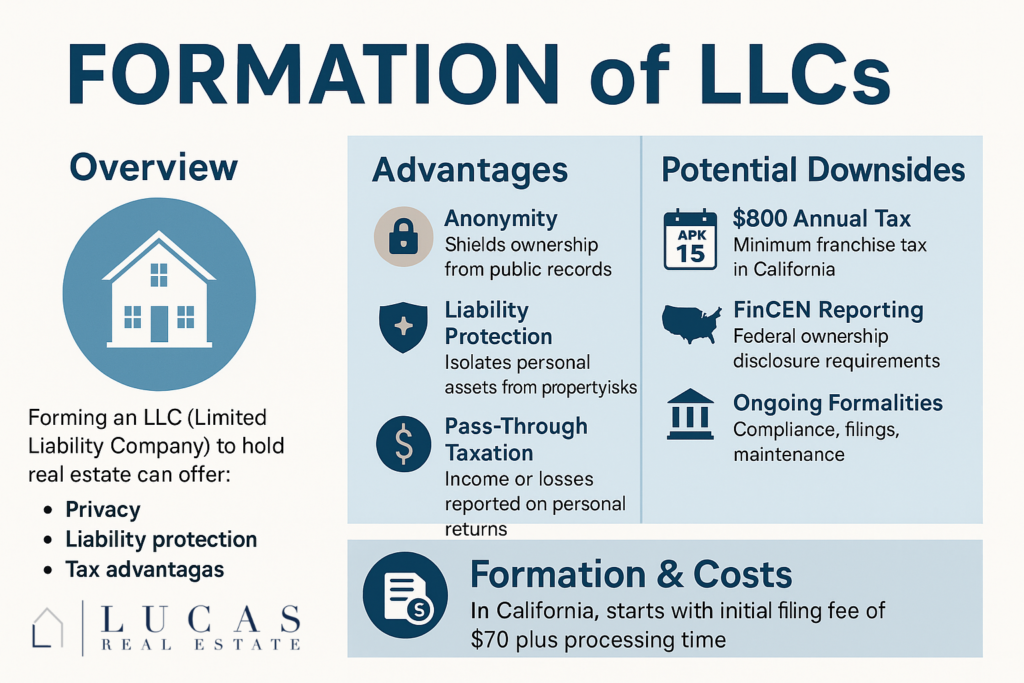

Forming an LLC (Limited Liability Company) to hold real estate can offer powerful benefits—but only when structured correctly. Common motivations include:

-

Privacy from public ownership records

-

Liability protection from tenant or property-related lawsuits

-

Tax advantages through pass-through taxation (vs. double taxation faced by C-Corporations)

-

Estate planning and generational wealth transfer

-

Avoiding reassessment of property taxes in some circumstances

We regularly assist clients forming LLCs for properties in Newport Beach, Laguna Beach, Coastal Orange County, and beyond—especially in cash transactions or high-value assets.

Key Considerations Before Forming an LLC

✔️ Privacy

While an LLC can provide anonymity, true privacy requires advanced structuring—such as using a trusted attorney or third party to shield names from public filings. Note: All beneficial owners must now be reported under new FinCEN regulations (not publicly disclosed, but federally required).

✔️ Liability Protection

LLC protections only apply if the entity is properly formed and used. That means all leases, payments, and contracts must be in the LLC’s name, and personal and business finances must remain separate.

✔️ Mortgage Clauses

Transferring a mortgaged property into an LLC may violate your lender’s “due on sale” clause. We’ll help you assess risk and alternatives.

Benefits of Using an LLC

-

Anonymity & Asset Privacy – Ideal for high-net-worth or public individuals

-

Lawsuit Protection – Keeps personal assets insulated from property-related claims

-

Tax Flexibility – Single-member LLCs enjoy pass-through tax treatment

-

Estate Planning – Simplifies long-term transfer and gifting strategies

-

Property Tax Strategy – May avoid reassessment with proper planning (see our Prop 19 Guide)

Challenges and Costs

-

$800 Minimum Annual Franchise Tax in California

-

Legal and CPA Maintenance – Ongoing compliance, filings, and strategic updates

-

Mortgage Issues – Potential “due on sale” triggers

-

Multi-Owner Complexity – Requires a detailed Operating Agreement and may lend to additional filings especially pertaining to taxes and reporting income.

Our Process & Pricing

We begin every LLC formation with a personal consultation to determine the right structure for your goals. Our fees include flat-rate packages for clarity and transparency.

Pricing starts at $1,000 for a basic single-member LLC (consultation credit applied).

Property transfers into the LLC can be added at modest additional cost.

Government Fees (California):

-

$70 – Initial Filing

-

$20 – Biannual Statement of Information

-

$800 – Annual Franchise Tax

-

Rush Filing: Add $350 (paid directly to the state)

Processing time: 5–7 business days (rush available)

Start the Process Today

Whether you own a single rental condo or a portfolio of investment properties, we’ll help you explore whether an LLC is the right move—and guide you every step of the way.

Schedule a consultation

info@lucas-real-estate.com | 949-478-1623

Contact us today at info@lucas-real-estate.com or call 949-478-1623 to start your LLC formation process.