This Fall, throughout Newport Beach, Costa Mesa and most Orange County communities, there are more and more active listings and less and less closed sales, leading to a flurry of price reductions and open houses, with sellers eager to make a deal.

While by no means a “burst bubble”, there is a clear slowdown of buyers, while concurrently many new sellers are coming in too late to the last few years of booming prices.

This extensively shifts the housing market from a hot sellers market, to a more balanced market. Coupled with rising interest rates, buyers on the fence have significant opportunity at this time.

A BALANCED MARKET AND HOW WE GOT HERE

Simple economics: The “supply and demand crisis” that partially lead to increased pricing over the past decade has finally boomeranged.

Foremost, there are less and less buyers due to affordability, rising interest rates, frustration, lifestyles that favor renting, lack of ‘move up’ buyers as people age in their homes longer, and countless other factors. Many of those not already priced out of the market (only 20 percent of Orange County residents can even afford the median priced O.C. home, per Q2 data from the California Association of REALTORS®) have simply elected to wait. Rising interest rates and rising prices over the past few years have created a ‘double whammy’ for buyers (i.e. the price of the home has gone up, as has the costs of the loan).

Concurrently, many homeowners – seeing enormous gains over the past several years, and perhaps with newfound ability to ‘move up’ – have finally decided to sell, creating an influx of new listings at peak pricing, just as waves of buyers have exited the marketplace.

This is naturally creating a more balanced market, not a housing catastrophe (indeed, many believe a ‘correction’ is needed, along with other factors, to create more homebuyer opportunities, creating a better long-term housing market).

INTEREST RATES WILL RISE AGAIN THIS WINTER AND THROUGHOUT 2019, CREATING ENORMOUS “SAVINGS” IN LOWER PAYMENTS FOR BUYERS WHO ACT NOW

For those financially able to buy, waiting may continue to cause grave regret, especially when interest rates are factored in.

A 30-year fixed interest rate under 5 percent is still available today. Interest rates will exceed 5 percent and beyond (with many experts predicting 6 percent or more) into 2019. The Board of Governors of the Federal Reserve is expected to raise interest rates again at the pending December 2018 meeting and three more times in 2019. (See citations below.)

The below examples and linked charts show how interest rates impact the overall costs of housing far more than the actual price of the home. With rising interest rates factored in, able buyers should consider striking now, while sellers are poised for price reductions and other incentives such as payment of closing costs.

While it is unrealistic to expect a dramatic reduction in pricing, there is a clear slowing with many sellers eager to close (and/or were overpriced to begin with) creating enormous opportunities, especially for homes that have been on the market for more than 60-days.

(Down payment requirements and other factors continue to make homeownership out of reach for some; But many can afford to buy, but have been choosing to ‘wait’ for prices to come down… those individuals must carefully consider the costs of waiting. There are additional inherent argument for and against buying well beyond the scope of this article, which focuses on a market update and interest rate buying power).

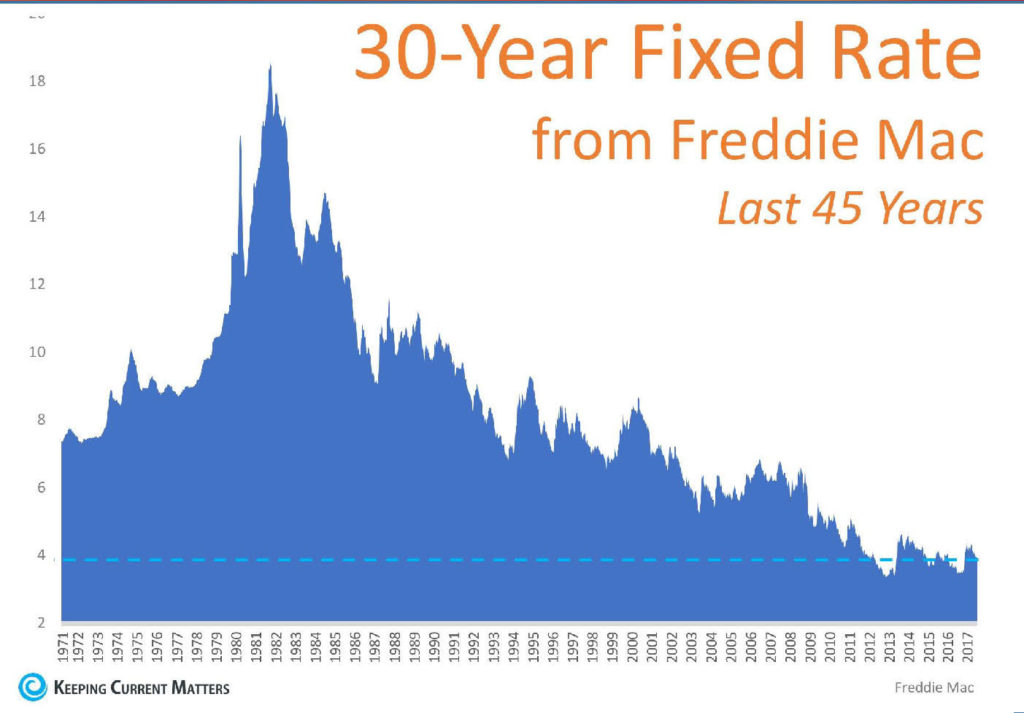

HISTORICAL RATES

Many find it hard to believe (or recall) that interest rates were well over 10 percent throughout the 1980’s (peaking at 18.63 percent in 1981). Interest rates remained well over 6 percent throughout the 1990s and 2000s.

Many find it hard to believe (or recall) that interest rates were well over 10 percent throughout the 1980’s (peaking at 18.63 percent in 1981). Interest rates remained well over 6 percent throughout the 1990s and 2000s.

With the recession, as part of government stimulus to reboot the economy, interest rates took a dive below 6 percent in 2009 and continued to go lower and lower, until reaching a low point of 3.31 percent in 2012.

Interest rates remained at that historical low, but began slowly creeping back up and now hover between 4.5 and under 5.0 percent.

Many blame the low interest rates for contributing to the boom over the past several years, as artificially low rates allowed more ‘buying power’ (i.e. ‘offset’ the increasing prices).

BUYING POWER OF LOWER INTEREST RATES

The below examples highlight the enormous buying power of the current – and still historically low – interest rates, hovering between 4.5 and under 5.0 percent.

Take a $700,000 loan for example:

- 4.5 Percent Interest Rate = $3,547/mo. and a total cost of $1,276,847.

- 5 Percent Interest Rate = $3,758/mo. and a total cost of $1,352,790. That is $211 more per month, $2,532 more per year, and a total costs of $75,943 more over the life of the loan vs. the 4.5 percent rate.

- 5.5 Percent Interest Rate = $3,975/mo. and a total cost of $1,430.828. That is $428 more per month, $5,136 more per year, and a total costs of $153,981 more over the life of the loan vs. the 4.5 percent rate.

Take a $1,500,000 loan for example:

- 4.5 Percent Interest Rate = $7,600/mo. and a total cost of $2,736,101.

- 5 Percent Interest Rate = $8,052/mo. and a total cost of $2,898,837. That is $452 more per month, $5,424 more per year, and a total costs of $162,736 more over the life of the loan vs. the 4.5 percent rate.

- 5.5 Percent Interest Rate = $8,517/mo. and a total cost of $3066061. That is $917 more per month, $11,004 more per year, and a total costs of $329,960 more over the life of the loan vs. the 4.5 percent rate.

These example payments on a 4.5 percent to 5.5 percent interest rate show the enormous buying power of lower rates.

CONCLUSION

5.5 percent rates will happen in 2019, with many experts predicting 6 percent or more. (See below citations and additional articles.)

The purchasing power of today’s still historically low rate cannot be overstated. For those financially able to buy, waiting may continue to cause grave regret, especially when interest rates are factored in.

Now is the time to strike – sellers are more motivated than ever to offer price reductions and other concessions, coupled with still low interest rates. While the price of housing may dip into 2019, interest rates are assured to raise, likely at a pace far in excess of any price drop. Thus, for qualified buyers looking for their long-term home, there is no sense in ‘waiting’ any longer.

——————-

Lucas Real Estate readily assists buyer clients with purchases, especially in the areas of Newport Beach, Costa Mesa and coastal Orange County California.

– Devin Lucas

Author Devin R. Lucas is a Real Estate Attorney, Broker and REALTOR®, specializing in Newport Beach, Costa Mesa and Orange County coastal communities, serving individual and investors in residential real estate. Courtney Lucas, licensed CPA, Real Estate Salesperson and REALTOR®. Devin Lucas and Courtney Lucas work in conjunction with Villa Real Estate, the area’s leading luxury brokerage.

Lucas Real Estate

Real Estate Law | Real Estate Transactions | REALTORS®

lucas-real-estate.com | devin@lucas-real-estate.com | BRE No. 01912302

949.478.1623 office | 888.667.6038 fax

2901 West Coast Highway Suite 200

Newport Beach | California | 92663-4023

| Official Site | Blog | LinkedIn | Facebook | Pinterest | Google + | Yelp | Avvo | Twitter | Zillow |

SOURCES / CITATIONS

- Reports on Housing: http://reportsonhousing.com/

- Bankrate.com: www.bankrate.com/mortgage.aspx

- Wellsfargo.com

- Bankofhope.com

- Reuters: https://www.reuters.com/article/us-usa-fed-kaplan/feds-kaplan-sees-three-more-interest-rate-hikes-likely-idUSKCN1MY220.

- The Wall Street Journal: https://www.wsj.com/articles/bond-investors-catch-up-with-feds-plans-1538767826

- USA Today: https://www.usatoday.com/story/money/2018/09/26/fed-raises-rate/1426946002/

- Associated Press: https://www.apnews.com/864ad1c8c02547f09722467e47a0a35e

- Board of Governors of the Federal Reserve Calendar: https://www.federalreserve.gov/monetarypolicy/fomccalendars.htm

- Value Penguin: https://www.valuepenguin.com/mortgages/historical-mortgage-rates#nogo

- Q2 data from the California Association of REALTORS®: CAR.org

—————————————

Disclaimer

The content on this blog is for informational purposes only. Nothing on this blog should be construed to be legal advice, and you should not act or refrain from acting on the basis of any content on this blog without seeking appropriate legal advice regarding your particular situation, from an attorney licensed to practice law in your state. The content on this blog is not guaranteed to be correct, complete, or up to date. Devin R. Lucas’ office is in Newport Beach, California and is only licensed to practice law in California. Please be advised that Devin R. Lucas only provides legal services or advice pursuant to a written legal services agreement. The content on this blog is not intended to, and does not, create an attorney-client relationship between you and Devin R. Lucas, nor does our receipt of an email or other communication from you. Some jurisdictions may consider this site to constitute attorney advertising; accordingly, please be advised this is an advertisement.

IRS CIRCULAR 230 DISCLOSURE: To ensure compliance with requirements imposed by the IRS, we inform you that, to the extent this communication (or any attachment) addresses any tax matter, it was not written to be (and may not be) relied upon to (i) avoid tax-related penalties under the Internal Revenue Code, or (ii) promote, market or recommend to another party any transaction or matter addressed herein (or in any such attachment).