Is there a Prop 19 loophole? Some legal strategies may still offer a narrow pathway to property tax continuity despite Prop 19’s gutting of longstanding California law earlier allowing for parent-child transfers without reassessment. One such approach—commonly referred to as the “Prop 19 LLC workaround” or “Prop 19 workaround” or “Prop 19 loophole”.

California’s Proposition 19 dramatically reshaped the rules for passing down real estate between generations. For decades under Propositions 58 and 193, families could transfer primary residences—and even other properties—to children without triggering reassessment. But since Prop 19’s February 2021 implementation, those rights have been effectively eliminated, unless the child moves into the home as a primary residence and the value falls within a capped threshold. This has forced many families in high-appreciation areas such as Newport Beach and elsewhere to sell their family homes upon inheritance as the increased property tax bill would be too great.

For families who didn’t or couldn’t act before the deadline, some legal strategies may still offer a narrow pathway to property tax continuity. One such approach—commonly referred to as the LLC workaround—relies on a careful structuring of real estate ownership through limited liability companies. While promising on paper, this strategy is complex, risky, and only suited for families with long-term goals and close coordination.

How It Works: California’s Legal Entity Rules

Under California Revenue & Taxation Code (RTC) §64(c), property held by a legal entity like an LLC is reassessed when one person obtains control (i.e., more than 50% of ownership). Additionally, under RTC §64(d), if real property was previously owned by individuals and then transferred into an LLC without reassessment (typically under RTC §62(a)(2)), a “cumulative transfer” of more than 50% of those original co-owners’ interests also triggers reassessment.

Thus, by avoiding both:

- a single party gaining majority control, and

- cumulative transfers exceeding 50% of originally co-owned property,

…it may be possible to defer reassessment indefinitely, provided certain criteria are met.

Buying Real Estate Directly in an LLC

When a property is purchased directly by an LLC, it is not subject to the “original co-owner” taint under RTC §64(d). This gives the owners greater flexibility in later transfers of LLC membership interests. As long as no one person ever acquires more than 50% ownership or control of the LLC, and all cumulative transfers stay under the 50% threshold, property tax reassessment can be avoided entirely.

This structure can be particularly attractive in high-value coastal markets like Newport Beach, where reassessment to current market value could mean tens of thousands of dollars in additional annual taxes. Buying through an LLC from the outset helps maintain planning flexibility for multi-generational holding strategies.

Transferring Real Estate into an LLC After Purchase

Conversely, when individuals transfer already-owned property into an LLC, the property may become subject to the “original co-owner” rules of RTC §64(d). Even if the initial transfer avoids reassessment under RTC §62(a)(2), any future cumulative transfer of more than 50% of those original ownership interests could later trigger reassessment.

This “taint” follows the property indefinitely, meaning even decades later, a gradual transfer to children or others could result in reassessment.

In this scenario, the origin of ownership matters. Property that was personally owned before being placed in an LLC carries more risk and is easier to trigger a reassessment, while property acquired directly by the LLC offers far more flexibility.

This distinction is vital for property owners in appreciating areas like Newport Beach, Eastside Costa Mesa, or Corona del Mar, where legacy homes now worth $4M–$6M+++ could face tax reassessments to those full market values — often forcing heirs to sell due to exorbitant annual property tax bills (generally 1% of the fair market value as of the date of death).

Examples of LLC Transfers and Reassessment Outcomes

✅ Example 1: No Reassessment – LLC Buys Property, Then Owner Passes and Inherited by Two or More Children

A mother forms an LLC and it directly purchases a rental property in Newport Beach. She owns 100% of the LLC. Upon her death, her 100% membership interest is split equally between her two children (50/50).

Result: No change in control occurs (neither child receives >50%), and the property is not reassessed.

Contrast with: If mother owned the property in her own name, then transferred to an LLC, then died and passed the LLC 50/50 to her two children, that would cause a reassessment.

Let’s discuss this further as to why this “works”: When a sole member of an LLC (who holds real estate that was acquired directly by the LLC, not contributed after personal ownership) passes away and that 100% membership interest is split 50/50 between two children, the transfer does not constitute a “change in control” under Revenue & Taxation Code §64(c), because:

- A “change in control” under §64(c)(1) occurs only when a person obtains more than 50% of the ownership interests in the legal entity.

- In this example, neither child obtains more than 50%, and thus no reassessment is triggered.

Even though the mother has died and a new generation is now managing the LLC, no single heir has control, and thus no change in control occurs.

This situation assumes the LLC originally acquired the property directly and is not “tainted” under §64(d). If instead the property was originally held by the parent in their individual name and then contributed to the LLC, the “original co-owner” cumulative transfer rule would apply under §64(d), and eventually (at >50% cumulative transfer), reassessment would be triggered—even if no single person got more than 50%.

❌ Example 2: Full Reassessment – LLC Bought Property, One Heir Gets All

Same as above, but the mother leaves 100% of her LLC interest to just one child.

Result: The child obtains more than 50% control of the LLC. A change in control occurs, triggering 100% reassessment.

Consider: This is unfair in the “only child” scenario. Perhaps there are grandchildren to consider inheriting 50%, i.e. child 50%, others 50%, thus no reassessment. No Grandchildren yet – consider getting working on that.

❌ Example 3: Reassessment – Cumulative Transfers Over 50% (Tainted Property)

A couple transfers property they already own into an LLC. No reassessment initially due to proportional interests. Later, they give 25% to one child and 25% to another. The wife later gifts an additional 5%.

Result: Cumulative transfer exceeds 50% → Full reassessment under §64(d). Anytime the cumulative transfer exceeds 50%, the property will get a 100% reassessment. Thus when both parents die, game over. (see no. 5 below.)

✅ Example 4: Transfer with Spouse as Strategic Buffer (Tainted Property)

Parents each gift 25% of LLC interest to a child; the remaining 50% stays with the surviving spouse.

Result: No reassessment. Transfers under 50%, no one gains control. But, as with no. 3 above, this is all over when the remaining spouse passes away, at that time triggering a full reassessment (unless they originally purchased the property in an LLC).

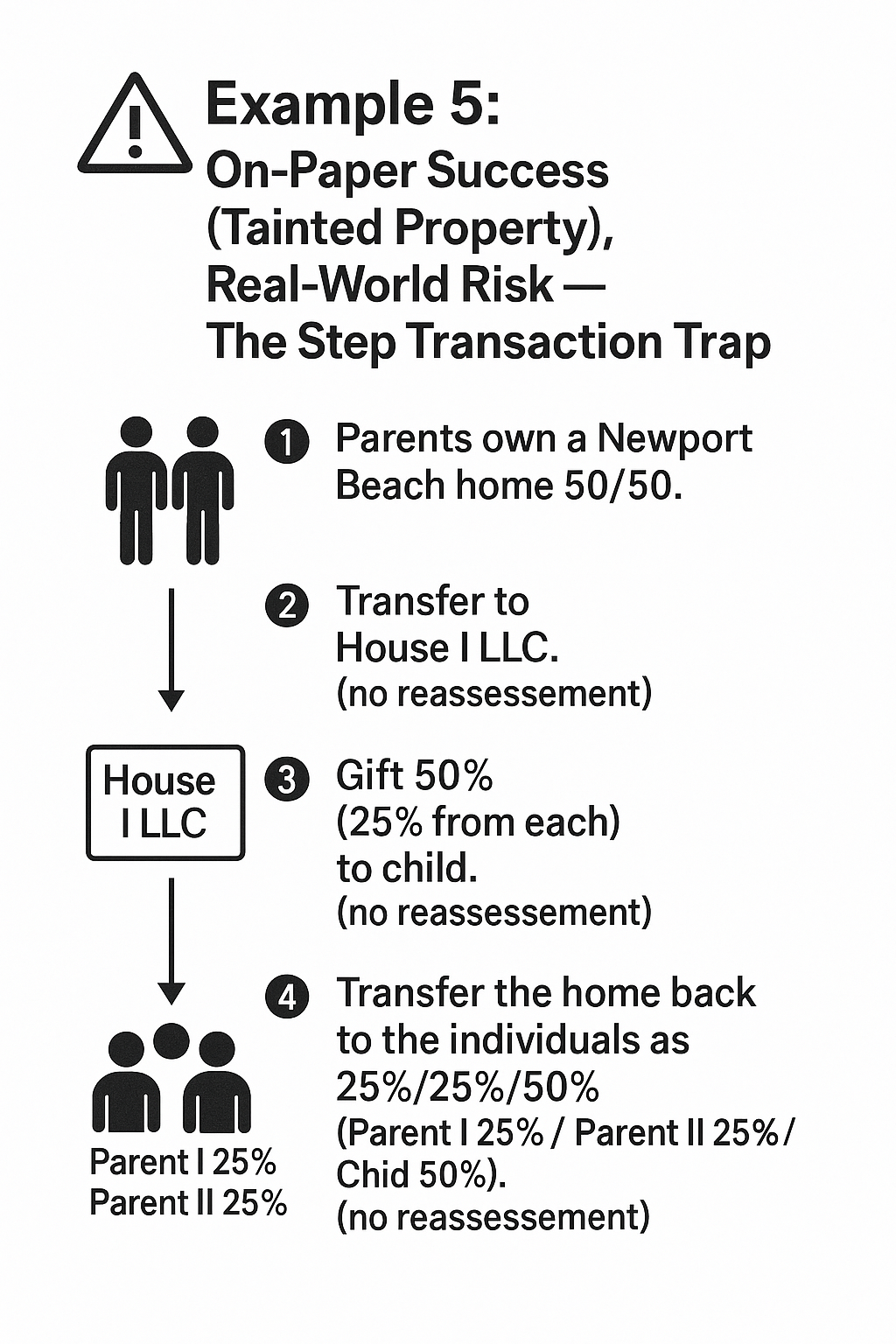

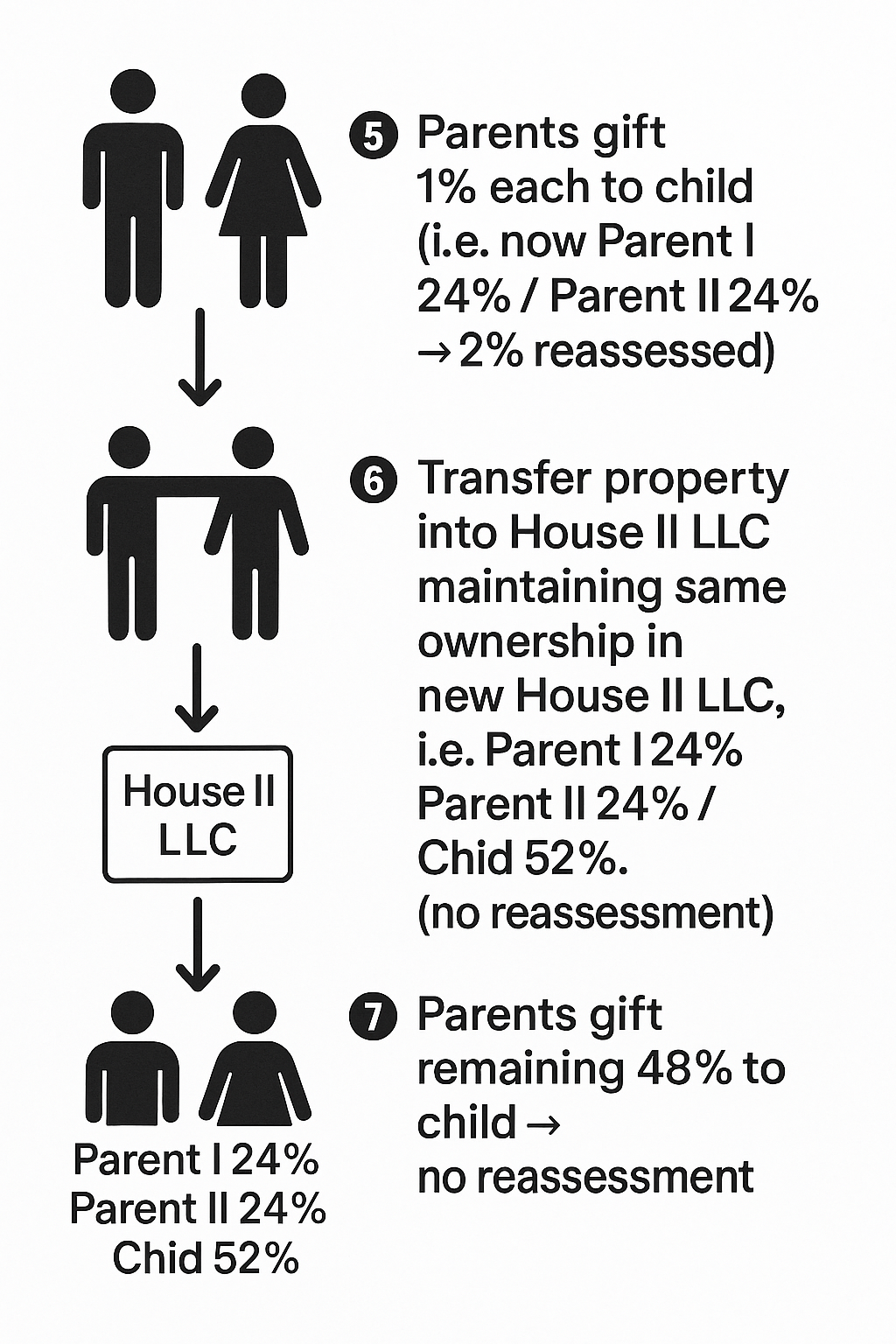

⚠️ Example 5: On-Paper Success (Tainted Property), Real-World Risk — The Step Transaction Trap

- Parents own a Newport Beach home 50/50.

- Transfer to House I LLC. (no reassessment).

- Gift 50% (25% from each) to child. (no reassessment).

- Transfer the home back to the individuals as 25%/25%/50% (Parent I 25% / Parent II 25% / Chid 50%). (no reassessment).

- Dissolve House I LLC.

- Parents gift 1% each to child (i.e. now Parent I 24% / Parent II 24% / Chid 52%) → 2% reassessed.

- Transfer property into House II LLC maintaining same ownership in new House II LLC, i.e. Parent I 24% / Parent II 24% / Chid 52%. (no reassessment).

- Parents gift remaining 48% to child → no reassessment.

Result: Legally structured, the parents have now transferred the property to the child with only a 2% reassessment (and perhaps that could even be reduced to a tiny fraction, but keeping it simple for illustrative purposes). However, this could potentially viewed as one transaction. If the step transaction doctrine applies, see below, the entire property could be reassessed.

Illustrated Example of hypothetical “Prop 19 LLC Workaround”:

Optional Spin on Example 5: In the example above, one could ‘stop’ (or at least ‘pause’) after the property has been transferred back into the individual names at Parent I 25% / Parent II 25% / Chid 50% (or even placed into two separate LLCs at this stage, i.e. Parent LLC and Child LLC, or in their own trusts, etc.). Here, if both parents pass away, there would only be a 50% reassessment of the property for that portion owned by the parents (either individually or via their LLC).

This could be the first “stage” (let’s not call it a “step”) in a longer approach to achieve the above goals. Coupled with legitimate reasoning for this initial gift – such as a desire to take advantage of currently high lifetime gift allowances, or have the child become an active member of the management team, etc. – one could be on their way to a legitimate path to avoid or minimize reassessment.

The Step Transaction Doctrine: Timing and Intent Matter

This strategy must be executed with great care. California assessors and courts may collapse a series of seemingly discrete transactions into one “integrated” step if the intent was clearly to circumvent reassessment. This is known as the step transaction doctrine, a judicial principle applied to invalidate tax avoidance schemes that are overly mechanical or lacking a legitimate business purpose.

To mitigate this risk, a legitimate purpose for each transfer should be documented—such as involving children in the management of the family business, or providing them with economic interests. There must be substantial time and independence between each step.

Key Authorities Applying the Step Transaction Doctrine

Gregory v. Helvering, 293 U.S. 465 (1935)

Summary: A taxpayer created and dissolved a corporation purely to reduce taxes on a stock sale. Though each step was legal, the Supreme Court ruled it a tax-avoidance scheme and disregarded the formality.

Ruling: The U.S. Supreme Court held that although each step was legal, the overall transaction was a sham intended solely to avoid taxes. The Court said the substance of the transaction, not its formal steps, should determine tax consequences.

Application: Courts and assessors may disregard multiple-step transfers of LLC interests if they appear engineered solely to avoid property tax reassessment.

Commissioner v. Court Holding Co., 324 U.S. 331 (1945)

Summary: A corporation negotiated a property sale, but just before closing, transferred the property to shareholders, who then sold it. The goal was to have the gain taxed at lower personal income tax rates rather than corporate rates.

Ruling: The Supreme Court held that the transaction was actually completed by the corporation, not the shareholders, and taxed it accordingly. “A sale by one person cannot be transformed for tax purposes into a sale by another by using the latter as a conduit through which to pass title.”

Application: This case reinforces that intent matters more than sequencing. If the assessor believes the parent still “controlled” the sale, or that steps were structured purely to shift the tax consequence, reassessment could apply.

Associated Wholesale Grocers, Inc. v. United States, 927 F.2d 1517 (10th Cir. 1991)

Summary: This case involved a complex multi-step plan to transfer stock in a way that minimized tax. The court analyzed whether to treat the multiple steps as one integrated event.

Ruling:The Tenth Circuit upheld the IRS’s decision to collapse the steps, applying one of three tests commonly used in step transaction analysis.

Three Tests Used by Courts:

1. Binding Commitment Test: Was there a binding obligation to complete all steps from the outset?

2. Mutual Interdependence Test: Could the steps have occurred independently, or were they meaningless unless completed together?

3. End Result Test: Was there a single intended outcome to which all steps were directed?

Application: In Prop 19 workarounds, assessors may apply any of these tests. If gifting 25% LLC interest, dissolving the LLC, and reforming it are interdependent or clearly aimed at passing property without reassessment, they could be treated as a single reassessable event.

The Big Tradeoff: Loss of the Step-Up in Basis

Even if reassessment is avoided, this strategy comes at a potentially significant cost: capital gains taxes.

Gifting LLC interests during your lifetime transfers your carryover basis—meaning your children will “step into your shoes” when they eventually sell the property. So when (if) they sell the property, they will be in the same position you would have been with regards to potential capital gains on the sale.

Whereas if they inherent (at death), Under IRC §1014, assets transferred at death typically receive a step-up in basis to fair market value, thereby eliminating prior capital gains.

Example: You bought a duplex in Newport Beach for $500,000 that’s now worth $2.5 million. If you gift it to your children through an LLC, they inherit your $500,000 basis. If they later sell, they may owe capital gains tax on $2 million. If they inherit it, their basis is stepped up to $2.5 million — no capital gains tax.

You can review our more in-depth article on the step up in basis here.

We’re Here to Help Educate and Strategize

At Lucas Real Estate Group, we’ve extensively educated families, trustees, and professionals on Proposition 19’s implications—before and after its implementation. We understand the complexity of planning with LLCs, trusts, and long-term property ownership across generations.

If you’re navigating intergenerational transfers of California real estate and want to explore your options—including LLC structures, capital gains strategies, and Prop 19 mitigation—we’re here to help.Devin R. Lucas is a Real Estate Broker, REALTOR® and Real Estate Attorney. Alongside Courtney Lucas, a licensed CPA and REALTOR®, they lead Lucas Real Estate Group in partnership with Coldwell Banker Global Luxury.

Lucas Real Estate Group offers unmatched expertise in California real estate, Prop 19 strategy, legal structuring, and discreet transactions.

Citations:

- RTC §64(c): Change in control

- RTC §64(d): Cumulative transfers

- RTC §62(a)(2): Proportional LLC transfer exclusion

- IRC §1014: Step-up in basis

- https://www.sfassessor.org/node/1476

- https://www.boe.ca.gov/proptaxes/leop.htm

- https://www.boe.ca.gov/proptaxes/leopcic.htm

- https://www.boe.ca.gov/proptaxes/leopcio.htm

- Gregory v. Helvering, 293 U.S. 465 (1935)

- Commissioner v. Court Holding Co., 324 U.S. 331 (1945)

- Associated Wholesale Grocers, Inc. v. United States, 927 F.2d 1517 (10th Cir. 1991)

Questions or Need Help?

Lucas Real Estate – REALTOR® and Attorney Devin Lucas and REALTOR® and CPA Courtney Lucas – are your local experts in property management and real estate sales and acquisitions in Newport Beach, Costa Mesa, Newport Coast, Corona del Mar, and all of Orange County.

Want to discuss real estate laws, tax planning, tax considerations, private sales, intra family sales, or real estate legal matters? We conduct paid one-hour confidential consultations via Zoom, walking families through Prop 19 impacts, potential tax exposure, capital gains considerations, and the pros and cons of gifting, sales, LLCs, or hybrid solutions. For discussions requiring real estate legal advice, private family sales, family transfers, or tax-related matters, please schedule a paid one-hour consultation via Zoom, phone, or in person using this calendar (Book a consultation here.) Upon booking, you’ll receive instant confirmation and a Zoom link if applicable.

Thinking of selling California real estate or seeking a new property management company? We would love the opportunity to assist – we provide full service sales and property management in Newport Beach, Costa Mesa and surrounding areas. If you are seeking to sell or professionally manage your home in Newport Beach, Costa Mesa or the surrounding areas, call or email anytime for a free brief consultation – info@lucas-real-estate.com or 949-478-1623.

Contact Us:

info@lucas-real-estate.com | 949.478.1623

Lucas Real Estate is a full-service brokerage offering residential real estate, legal services, and strategic tax planning—all under one roof.

Connect With Us

Check out our countless 5-star reviews and follow us on social media:

| Google Reviews | Yelp | LinkedIn | Zillow | Avvo | Facebook | Twitter | Instagram | YouTube | Official Site | Blog | Newsletter |

Sign up for our Newsletter here

—-Disclaimer —-

The content on this blog is for informational purposes only. Nothing on this blog should be construed to be legal advice, and you should not act or refrain from acting on the basis of any content on this blog without seeking appropriate legal advice regarding your particular situation, from an attorney licensed to practice law in your state. The content on this blog is not guaranteed to be correct, complete, or up to date. Devin R. Lucas’ office is in Newport Beach, California and is only licensed to practice law in California. Please be advised that Devin R. Lucas only provides legal services or advice pursuant to a written legal services agreement. The content on this blog is not intended to, and does not, create an attorney-client relationship between you and Devin R. Lucas, nor does our receipt of an email or other communication from you. Some jurisdictions may consider this site to constitute attorney advertising; accordingly, please be advised this is an advertisement.

IRS CIRCULAR 230 DISCLOSURE: To ensure compliance with requirements imposed by the IRS, we inform you that, to the extent this communication (or any attachment) addresses any tax matter, it was not written to be (and may not be) relied upon to (i) avoid tax-related penalties under the Internal Revenue Code, or (ii) promote, market or recommend to another party any transaction or matter addressed herein (or in any such attachment).