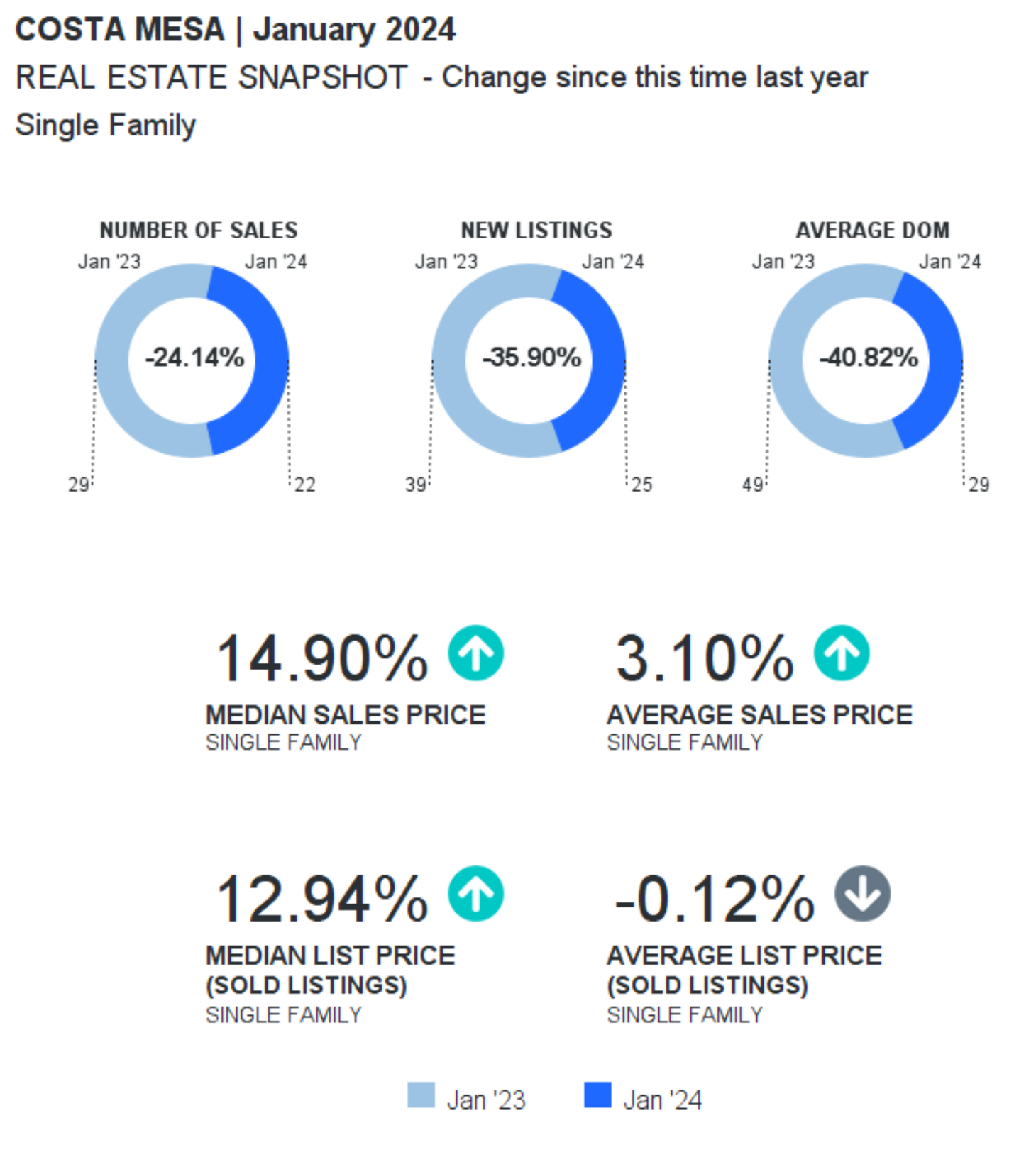

Here is your latest Costa Mesa single family homes for Activity Report for January 2024, analyzing data as it affects a specific market area.

Here is your latest Costa Mesa single family homes for Activity Report for January 2024, analyzing data as it affects a specific market area.

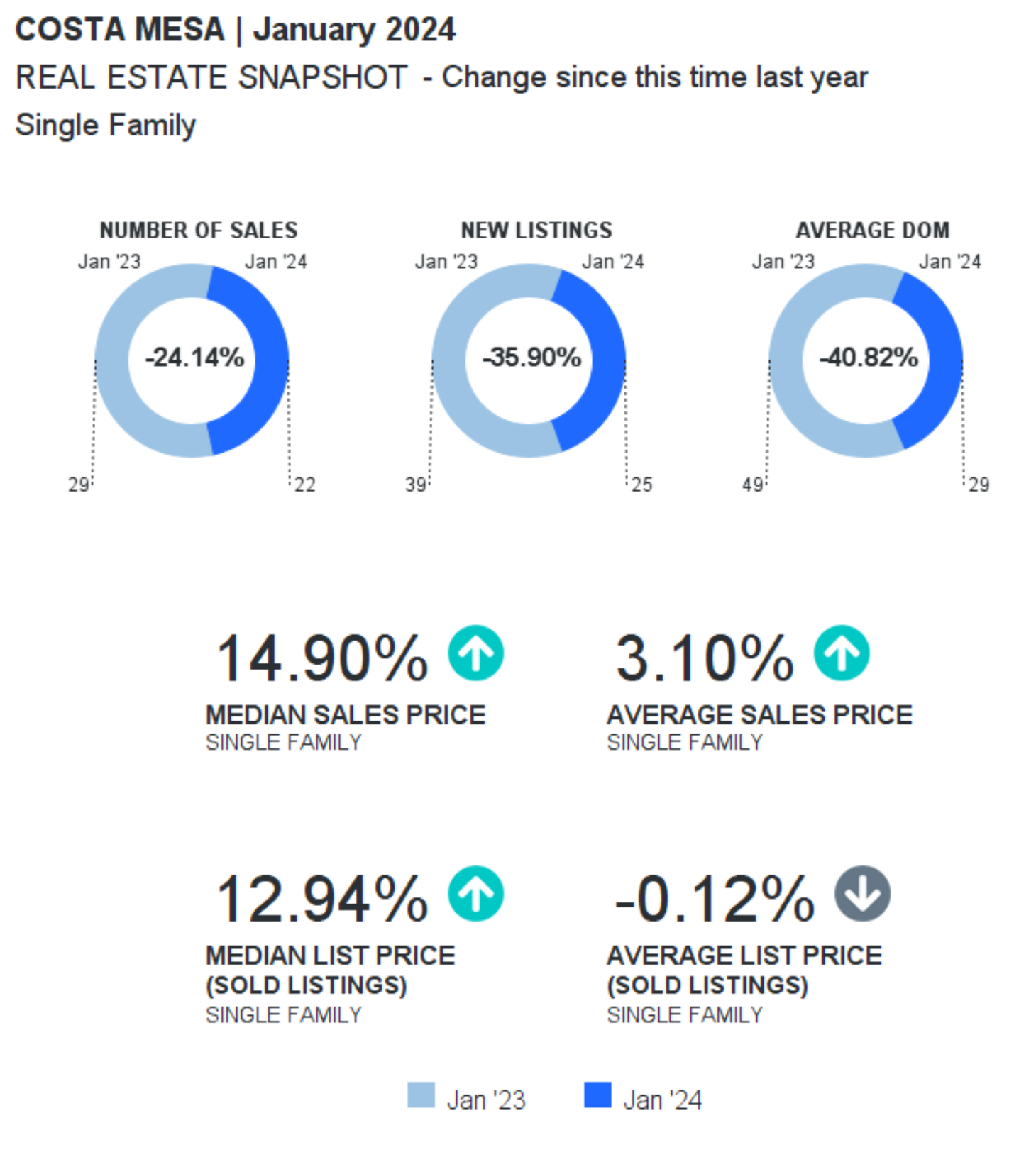

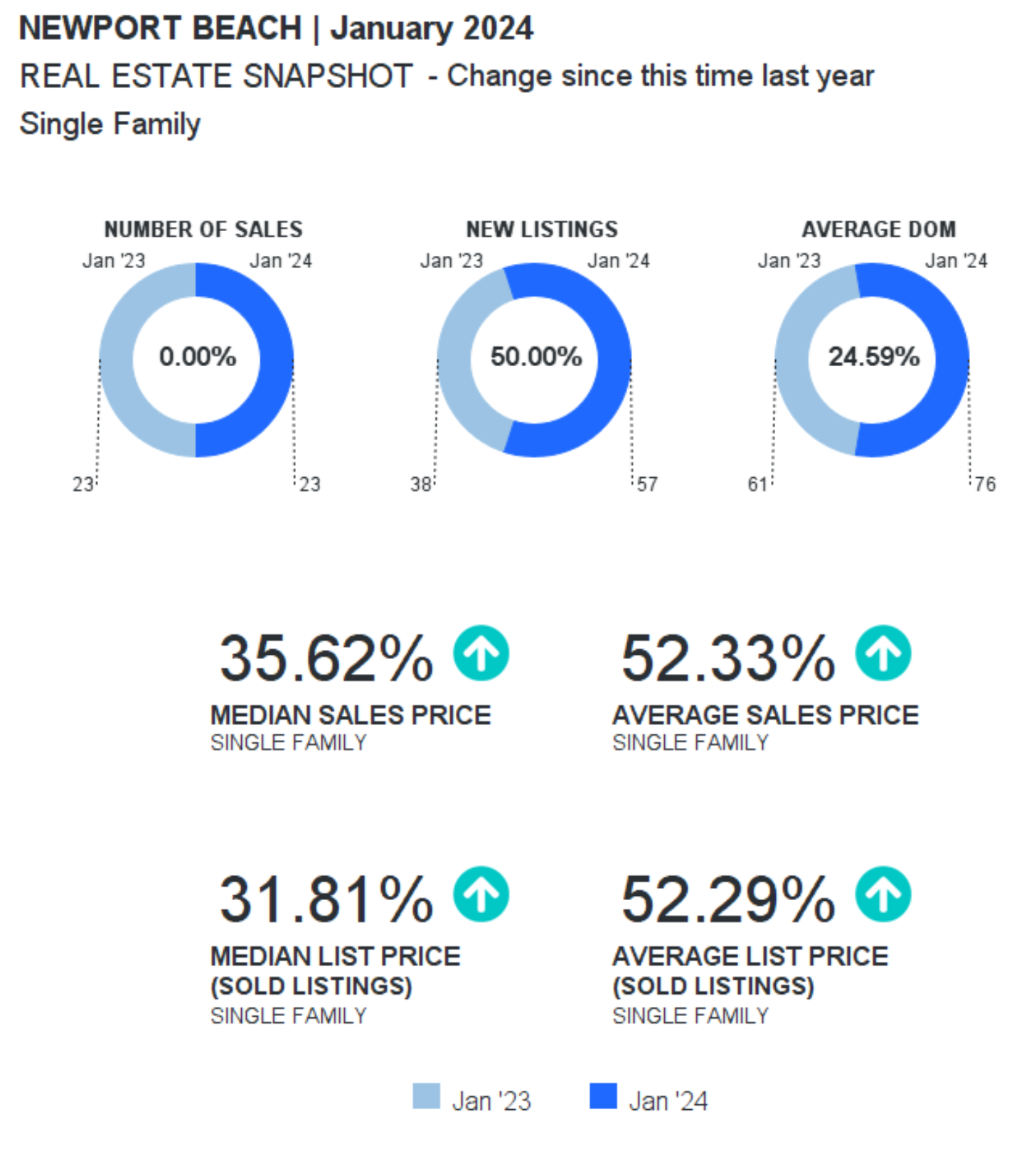

Here is your latest Newport Beach single family homes for Activity Report for January 2024, analyzing data as it affects a specific market area.

An update on the Prop 19 repeal efforts from The Howard Jarvis Taxpayers Association.

There is “as is”, and then there are “no contingencies” sales in California real estate. Here we explore a brief explanation on the difference.

The top five home improvements likely to supercharge your property’s resale value.

Here, we will breakdown of some of the key purchase documents, disclosures, escrow and title documents that you should pay especially close attention to during the sale or purchase and keep long after for legal and tax purposes.

California Association of REALTORS® Attorneys Jana Gardner and Dana Spears are joined by Attorney Allyson Richman of Californians for Homeownership to discuss the current state of Housing Development Laws in California and the role that Californians for Homeownership plays in promoting development by keeping an eye on local governments across the state. Learn more about Californians for Homeownership’s initiative.

Here is your latest Eastside Costa Mesa Activity Report as of January 28, 2024, analyzing data as it affects the specific market area of Eastside Costa Mesa. The Market Summary below offers a look at sales activity for the prior month and year, along with current and past year-to-date statistics. The graphs cover several different … Continue Reading

This is a simple update on the Capital gains tax rates for 2024, particularly in the sale of real estate.

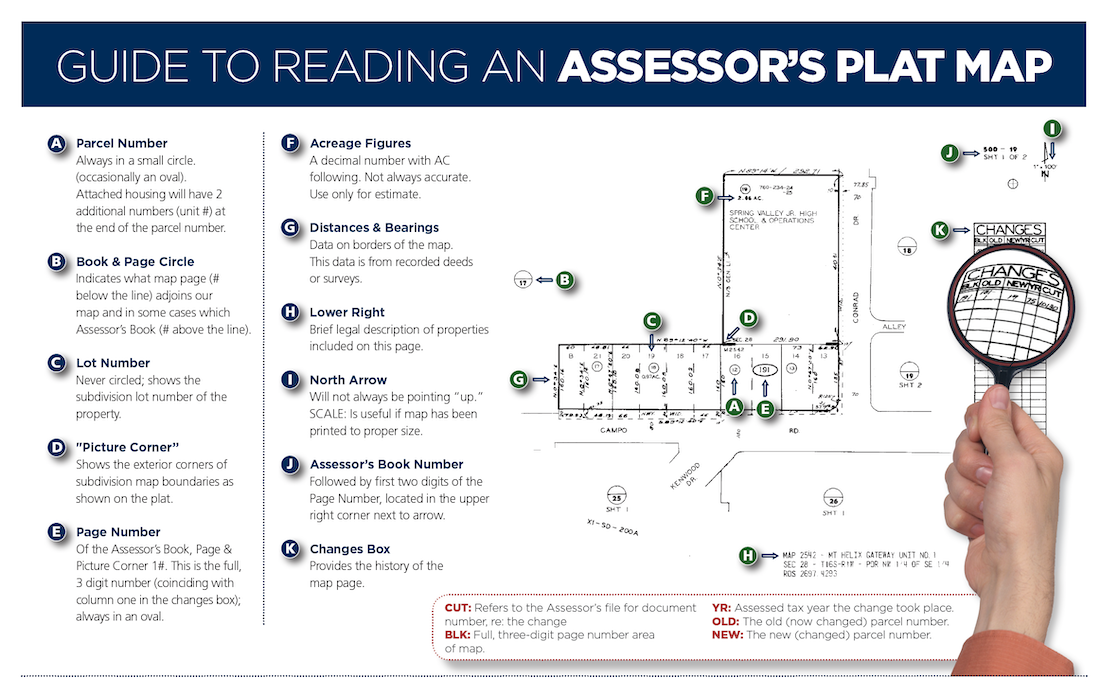

A plat map is a diagram used to show how property is divided within a county, city, or neighborhood. It serves as a guide to a tract of land that has been created by licensed surveyors, though it is NOT the same as an actual survey. It is a good starting point to understand your property boundaries.

Lucas Real Estate

2901 West Coast Highway Suite 200 | Newport Beach | California | 92663-4023

info@lucas-real-estate.com | 949.478.1623 office

Devin Lucas BRE No. 01912302 | Courtney Lucas BRE No. 02015514

Lucas Real Estate, a dynamic full-service residential real estate team led by Devin Lucas, REALTOR®, Real Estate Broker, and Real Estate Attorney, and Courtney Lucas, REALTOR® and CPA, offers unparalleled expertise in Newport Beach and surrounding areas.

Privacy Policy | Accessibility | Disclaimer | Newsletter | Social Media