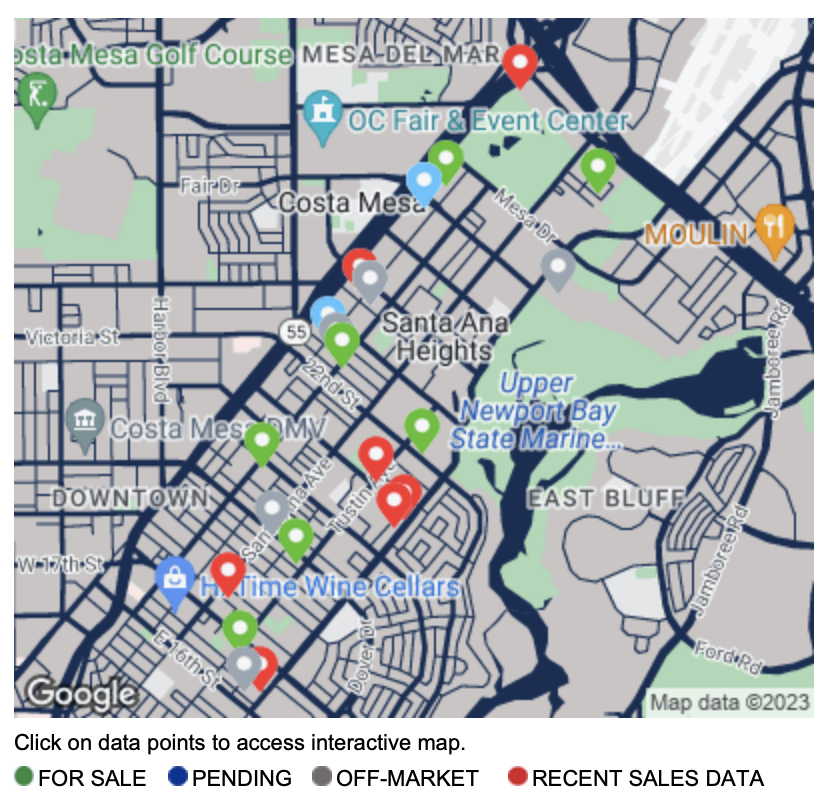

Here is your latest Eastside Costa Mesa Activity Report as of December 3, 2023, analyzing data as it affects a specific market area. The Market Summary below offers a look at sales activity for the prior month and year, along with current and past year-to-date statistics. The graphs cover several different aspects of the real estate market. Note how some of the graphs break out trends by price increments.