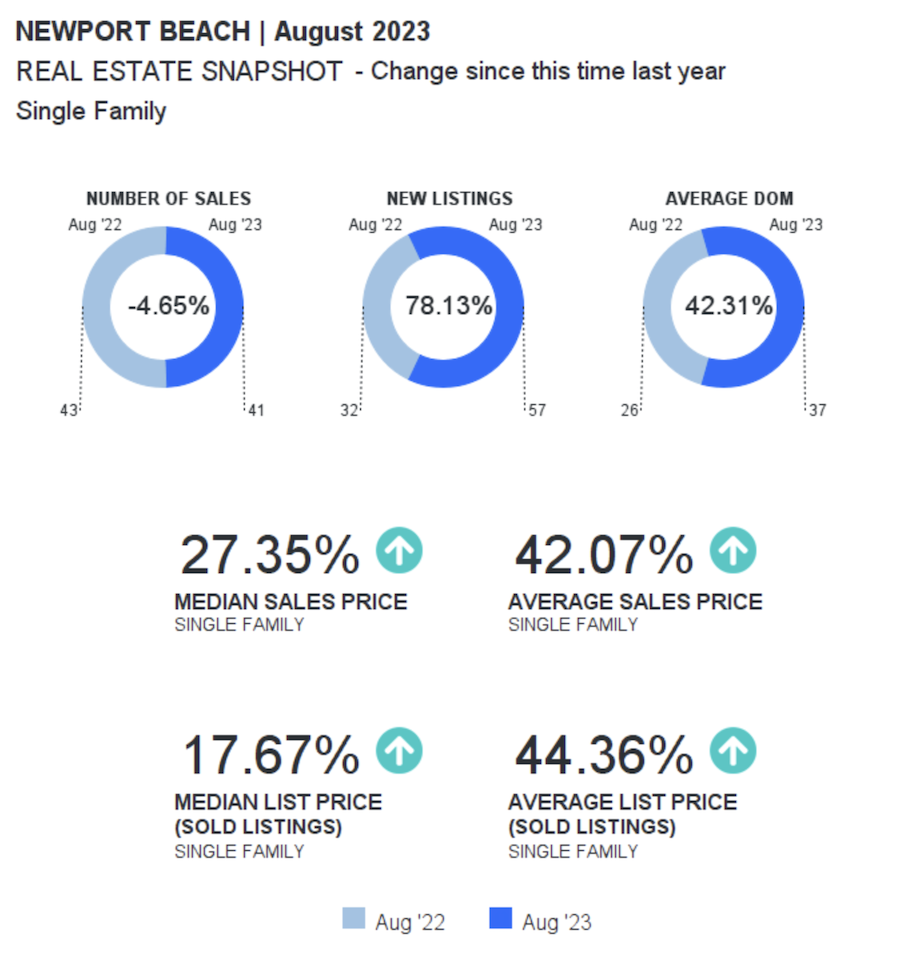

Here is your latest Newport Beach single family homes for Activity Report for August 2023, analyzing data as it affects a specific market area. The Market Summary below offers a look at sales activity for the prior month and year, along with current and past year-to-date statistics. The graphs cover several different aspects of the … Continue Reading