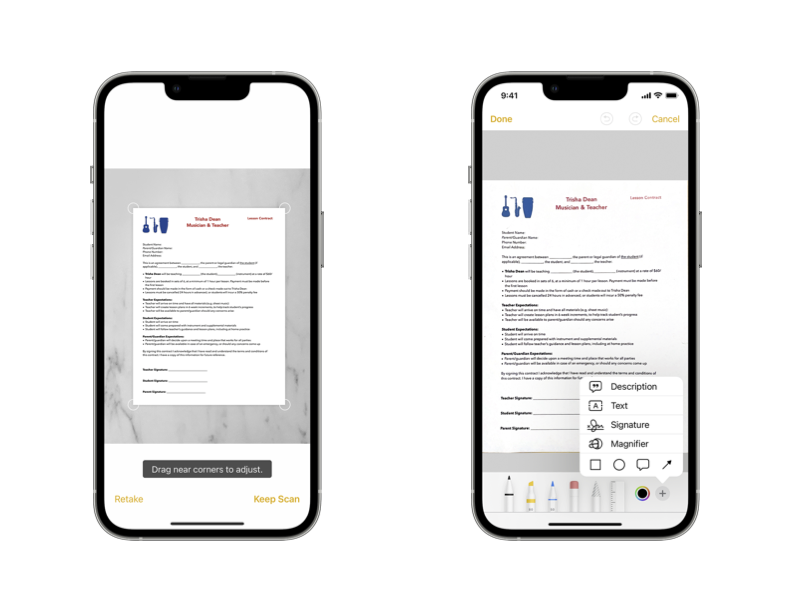

A little known feature feature built right into iPhone or iPad allows scanning and signatures of real estate documents (or any document for that matter).

A little known feature feature built right into iPhone or iPad allows scanning and signatures of real estate documents (or any document for that matter).

This office has seen first-hand a rise in real estate fraud whereby someone simply claims to be the “owner” of a property, obtains a loan against the property, and is off and running with your home’s equity. It’s shockingly easy and not surprisingly, it’s on the rise in California and elsewhere. Inherited properties, paid off … Continue Reading

This is an update to our earlier article on the 2016 implication of the Transfer on Death Deed in California. What is a Transfer on Death Deed Simply put, a Transfer on Death Deed (or “Revokable Transfer on Death Deed” or “TOD”) it is a deed, recorded on your property’s title, that allows for a … Continue Reading

Devin Lucas – REALTOR®, Real Estate Attorney, Real Estate Broker, and Principal at Lucas Real Estate – was recently published in the July 2023 edition of the Los Angeles legal magazine, Advocate Magazine, published by Consumer Attorneys Association of Los Angeles, with an article on residential real estate mediation and compliance with the California Association … Continue Reading

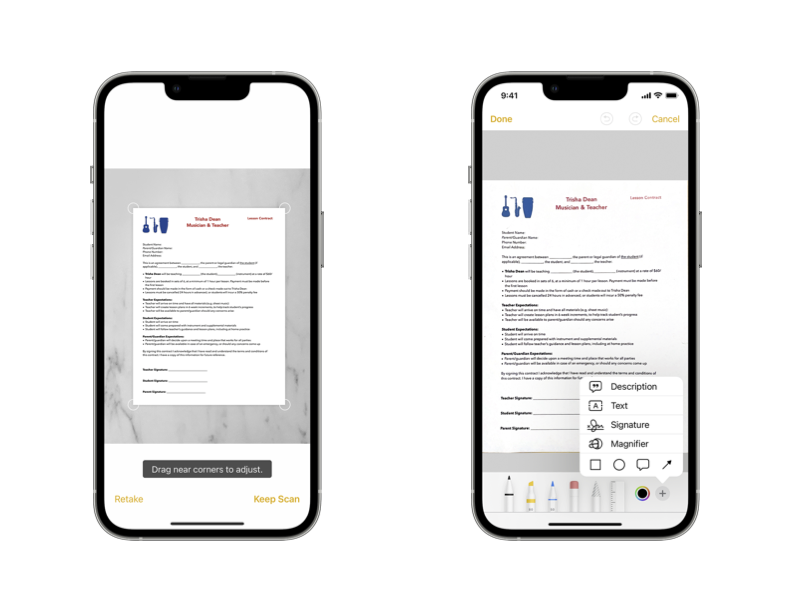

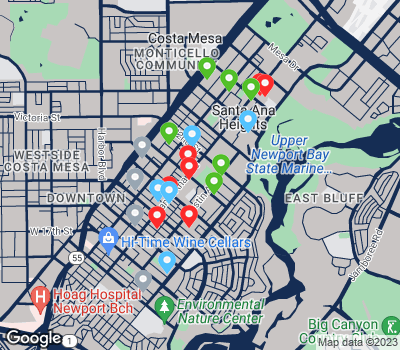

Here is your latest Newport Beach Activity Report, analyzing data as it affects a specific market area. The Market Summary below offers a look at sales activity for the prior month and year, along with current and past year-to-date statistics. The graphs cover several different aspects of the real estate market. Note how some of the graphs break out trends by price increments. Please contact us if you would like more information on the current market

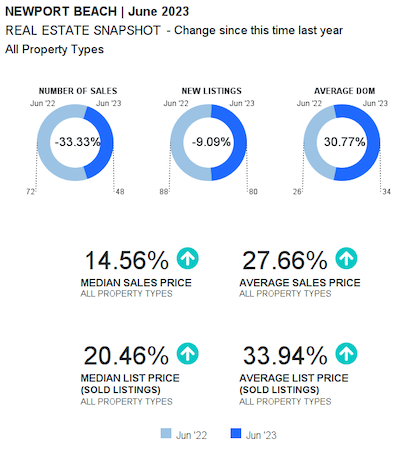

Here is your latest Costa Mesa Market Report, analyzing data as it affects a specific market area. The Market Summary below offers a look at sales activity for the prior month and year, along with current and past year-to-date statistics. The graphs cover several different aspects of the real estate market. Note how some of the graphs break out trends by price increments. Please contact us if you would like more information on the current market.

This Market Report contains detailed information about properties currently for sale or that have recently sold in Eastside Costa Mesa. This data will help track and assess values and trends in Eastside Costa Mesa. The report is based on current information from the regional Multiple Listing Service. If you need clarification on any of the figures or if you wish to take additional steps toward your property sale or purchase, please let us know. We are happy to help.

We are thrilled to be part of the Coldwell Banker Newport Beach office.

California Senate Bill 989 defers property taxes for taxpayers claiming Proposition 19 base year value transfers when the county assessor has not completed its determination of the property’s eligibility for property tax relief under that section. Additionally, the property tax bill must contain information regarding Proposition 19 base year value transfers and potential tax deferment in large counties.

The Howard Jarvis Taxpayers Association will go forward with an initiative to restore the right of parents to transfer their home and limited other property to their children without reassessment to market value.

Lucas Real Estate

2901 West Coast Highway Suite 200 | Newport Beach | California | 92663-4023

info@lucas-real-estate.com | 949.478.1623 office

Devin Lucas BRE No. 01912302 | Courtney Lucas BRE No. 02015514

Lucas Real Estate, a dynamic full-service residential real estate team led by Devin Lucas, REALTOR®, Real Estate Broker, and Real Estate Attorney, and Courtney Lucas, REALTOR® and CPA, offers unparalleled expertise in Newport Beach and surrounding areas.

Privacy Policy | Accessibility | Disclaimer | Newsletter | Social Media