Forming an LLC to Hold Real Estate in California

Lucas Real Estate – led by REALTOR® and Real Estate Attorney Devin R. Lucas and REALTOR® and CPA Courtney Lucas – are trusted experts in California LLCs, particularly for holding real estate in Newport Beach, Costa Mesa, Corona del Mar, Newport Coast, and other high-value areas along the Orange County coastline.

Ready to form an LLC? [View pricing and service options here.]

Have questions? Paid one-hour confidential legal consultations are conducted daily via Zoom and address virtually all questions, options, tax implications, and strategies. [Book a consultation here.]

Updated May 2025

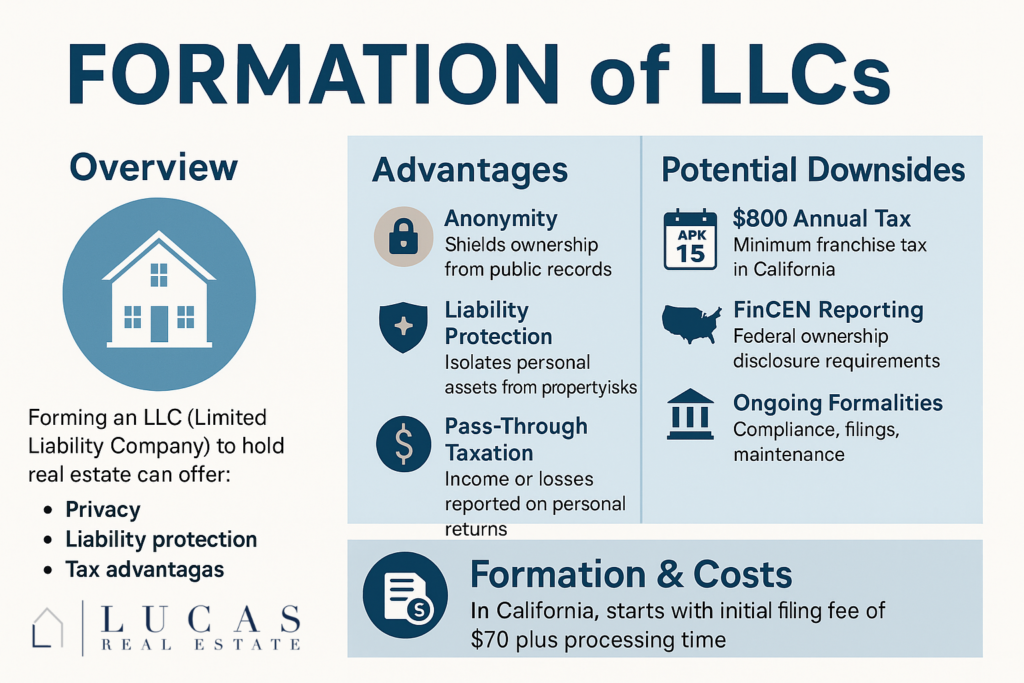

Forming an LLC (Limited Liability Company) to hold real estate is a long-standing and legitimate strategy used for estate planning, asset protection, privacy, and tax flexibility. It’s especially common in high-end, all-cash transactions across Newport Beach, Laguna Beach, and other Coastal Orange County neighborhoods.

Whether your portfolio includes a single condo or a series of commercial buildings, an LLC may be a powerful tool. Here’s why:

Privacy

An LLC adds a layer of privacy to property ownership. Instead of your personal name appearing in public databases and property records, the LLC is listed as the owner. This is especially valuable to celebrities, high-net-worth individuals, or anyone concerned about public visibility.

However, forming a California LLC does require listing a Manager in the Secretary of State’s public records. One strategy is to use an out-of-state LLC—such as a Wyoming LLC—as the Manager of the California LLC. Wyoming offers more privacy in its records, and using it as a manager adds an additional layer of privacy and modest protection by creating more complexity for potential creditors (though not complete insulation).

An “agent for service of process” is also required. Lucas Real Estate provides this service for a fee, ensuring that your filings are professional and compliant.

Strategic use of a trusted third party (like your attorney or family member) can preserve anonymity. With proper structuring, your personal identity can remain completely shielded from public view.

Liability Protection

Rental property ownership comes with serious risks—from routine repairs to catastrophic accidents. If someone is injured on your property and awarded a multimillion-dollar judgment, your insurance may not be enough to cover the loss.

This is where an LLC can act as a “bomb containment unit.“

If a property is properly held in an LLC, the legal liability is limited to that LLC and its assets—not your personal finances. Your other properties, bank accounts, or personal residence stay protected.

For optimal protection, consider placing each property in its own separate LLC, not a single LLC that holds all properties. Complex structures (like using a Corporation to manage multiple LLCs) can also be considered for larger portfolios.

An LLC Operating Agreement can also protect co-owners if one member faces a personal judgment. With proper drafting, creditors may be limited only to that member’s distribution rights.

Liability Example

Ideally, every landlord already has ample insurance for any such losses (at least $1 million, or much more). But that may not be enough. If someone is seriously injured on the property and obtains a $5 million award, your average $1 million insurance policy will be exhausted, leaving your entire assets as open targets for collection for the additional $4 million in liability.

However, in that same example, if the property was in a properly formed and maintained LLC, then the liability will be limited to the LLC’s insurance and assets—i.e., the property. If the property is worth $1 million, the creditor will likely get the property, but it will end there, with no collectability for the remaining $3 million award against you personally (and/or your other assets).

We call this the “bomb containment unit” principle: if a liability catastrophe explodes within your LLC property, the damage will be limited to the LLC property, and not expose your other assets.

For this reason, it’s not enough to have one corporation or one LLC hold all your property – each property should be its own LLC to ensure each property’s maximum liability is that property and its insurance coverage, not your other assets. As that gets more complex (i.e. apartment buildings or large portfolios), often a Corporation is formed to then own and manage the LLCs.

Similar protections exist if, for example, multiple individuals own the property and one co-owner has a judgment against them; a well-drafted LLC Operating Agreement may protect the entire LLC from a judgment creditor against just one co-owner, limiting the judgment creditor to that co-owner’s distributions, if any.

Tax Benefits

LLCs offer pass-through taxation, which avoids the “double taxation” burden faced by corporations. Instead of the entity paying taxes, the income or losses flow through to the individual members and are reported on their personal tax returns.

This treatment allows LLCs to combine the best of both worlds: liability protection with simplified, flexible taxation similar to a sole proprietorship or partnership.

Primary Residence in an SMLLC

If your primary residence is held in a Single-Member LLC (SMLLC), you may still qualify for the IRS Section 121 capital gains exclusion — currently $250,000 for individuals or $500,000 for married couples. California recognizes a married couple as one member for SMLLC purposes.

California Franchise Tax and Fees

All LLCs formed or doing business in California must pay the $800 annual Franchise Tax, regardless of income. And yes, even a Wyoming or other out-of-state LLC must register in California if it is “doing business” here. This is defined broadly and includes situations where a Member or Manager resides in California.

Additional fees apply based on gross receipts over $250,000 per year. There is also a $70 formation fee and $20 biannual Statement of Information filing.

Maintenance

Your Statement of Information must be filed every two years by the end of the original registration month—and can be filed early.

Each year, you must also:

- Pay the $800 minimum Franchise Tax

- File LLC Tax Voucher (FTB 3522)

- File Form 568 (Limited Liability Company Return of Income)

- If gross receipts apply, pay additional fees using FTB 3536

Refer to the FTB LLC Guide for full details.

On the federal level, your LLC must report income and possibly make a tax classification election with the IRS via Form 8832. By default:

- A single-member LLC is treated as a disregarded entity

- A multi-member LLC is treated as a partnership

If desired, you can elect to be taxed as a corporation. For more information, visit the IRS LLC Classification Page.

We strongly recommend sharing all formation documents with your CPA and financial advisors to ensure timely compliance.

Property Tax Considerations (Prop 19)

California property tax law treats LLC ownership differently than individual ownership. Transferring property into an LLC without changing ownership structure (i.e., you and your spouse remain the owners) does not trigger reassessment.

However, changes in actual ownership—like gifting part of the LLC to someone else—may trigger full reassessment.

There are legal strategies involving LLCs that, when properly structured and supported by a legitimate basis, may help reduce or delay reassessments under Proposition 19.

Estate Planning

An LLC fits seamlessly into a well-designed estate plan. Your living trust can own your LLC interests, and over time, you can gift portions of your LLC to heirs within IRS gift tax limits, gradually reducing the taxable value of your estate.

LLCs provide structure, flexibility, and protection for intergenerational wealth transfers.

Downsides to Consider

Mortgage Considerations

If there is a mortgage on your property, you likely cannot transfer the property into an LLC without risking the “due on sale clause” of your mortgage. Most lenders want the property held by an individual or a trust, not an LLC (for the precise opposite reasons you may want an LLC). If you have a mortgage, read it and check with your lender before executing any transfer.

Co-Ownership Complexities

Any co-ownership of property, LLC or not, must have a well-drafted Ownership Agreement (or LLC Operating Agreement) to clearly set out each party’s ownership and responsibilities.

There are certainly costs to form and maintain a proper LLC. Many property owners opt to forgo these additional expenses and “hassle” in favor of additional insurance.

Best Practices

- EIN: Apply for an Employer Identification Number (EIN) via the IRS website. Required to open bank accounts and for tax purposes.

- Trust Ownership: If you have a trust, the LLC membership should generally be owned by the trust. Consult your estate planner or our office.

- LLC Bank Account: Open a separate bank account for the LLC and pay all property-related expenses through it.

- Title Transfers: Property must be transferred properly into the LLC to avoid reassessment. We can help.

- Insurance: Update all insurance policies to name the LLC as the insured, with you as an additional insured.

- Utilities & Leases: Update both to reflect LLC ownership. Tenants should pay rent to the LLC.

- Licensing & Branding: Update city business licenses, payroll, and branding materials to reflect LLC ownership.

Lucas Real Estate – REALTOR® and Attorney Devin Lucas and REALTOR® and CPA Courtney Lucas – are your local experts in real estate LLC formations across Newport Beach, Costa Mesa, Newport Coast, Corona del Mar, and all of Orange County.

Ready to form an LLC? [View pricing and service options here.]

Need expert advice? Have questions? Paid one-hour confidential legal consultations are conducted daily via Zoom and address virtually all questions, options, tax implications, and strategies. [Book a consultation here.]

-Devin Lucas

Lucas Real Estate Group is a top-rated residential real estate team based in Newport Beach, led by Devin R. Lucas – a Real Estate Attorney, Broker, and REALTOR®, and Courtney Lucas – CPA and REALTOR®. We specialize in trust sales, intra-family transfers, luxury transactions, and confidential representation, offering unmatched experience in California property tax law, Proposition 19, and beyond.

Serving Newport Beach, Eastside Costa Mesa, and surrounding Orange County communities

(949) 478-1623 | info@lucas-real-estate.com

www.lucas-real-estate.com

2901 West Coast Highway, Suite 200, Newport Beach, CA 92663

Sign up for our Newsletter here

Author Devin R. Lucas is a Real Estate Broker, REALTOR® and Real Estate Attorney specializing in Newport Beach, Costa Mesa, and Orange County coastal communities. Courtney Lucas, a licensed CPA, Real Estate Salesperson, and REALTOR®, provides expert financial insight alongside real estate services. Together, they lead Lucas Real Estate, operating in conjunction with Coldwell Banker, the region’s premier luxury brokerage.

Lucas Real Estate offers unmatched expertise in California real estate sales, property management, capital gains strategies, and property tax matters, including Propositions 13, 58, 193, 60, 90, and new Proposition 19.

Contact Us:

(949) 478-1623 | info@lucas-real-estate.com

Check out our countless 5-star reviews and follow us on social media:

| Google Reviews | Yelp | LinkedIn | Zillow | Avvo | Facebook | Twitter | Instagram | YouTube | Official Site | Blog | Newsletter |

Sign up for our Newsletter here

sources:

https://www.ftb.ca.gov

https://www.ftb.ca.gov/file/business/types/limited-liability-company/single-member-llc.html

IRS Section 121: https://www.law.cornell.edu/cfr/text/26/1.121-1

—-Disclaimer —-

The content on this blog is for informational purposes only. Nothing on this blog should be construed to be legal advice, and you should not act or refrain from acting on the basis of any content on this blog without seeking appropriate legal advice regarding your particular situation, from an attorney licensed to practice law in your state. The content on this blog is not guaranteed to be correct, complete, or up to date. Devin R. Lucas’ office is in Newport Beach, California and is only licensed to practice law in California. Please be advised that Devin R. Lucas only provides legal services or advice pursuant to a written legal services agreement. The content on this blog is not intended to, and does not, create an attorney-client relationship between you and Devin R. Lucas, nor does our receipt of an email or other communication from you. Some jurisdictions may consider this site to constitute attorney advertising; accordingly, please be advised this is an advertisement.

IRS CIRCULAR 230 DISCLOSURE: To ensure compliance with requirements imposed by the IRS, we inform you that, to the extent this communication (or any attachment) addresses any tax matter, it was not written to be (and may not be) relied upon to (i) avoid tax-related penalties under the Internal Revenue Code, or (ii) promote, market or recommend to another party any transaction or matter addressed herein (or in any such attachment).