Proposition 33 seeks to repeal the Costa-Hawkins Rental Housing Act, a law passed in 1995 that limits the scope of rent control across the state. While tenant advocates view this measure as a step toward making housing more affordable, opponents argue that it will worsen the housing crisis by discouraging new construction and reducing the number of available rental units.

As property owners and landlords in Newport Beach, Costa Mesa, and other coastal Orange County communities, it’s essential to understand how Prop. 33 could impact both the local real estate market and your property investments.

What is Proposition 33?

Proposition 33 would overturn the protections established by the Costa-Hawkins Rental Housing Act, which has played a crucial role in stabilizing California’s rental market for nearly 30 years. Costa-Hawkins prevents cities from imposing rent control on single-family homes and apartments built after 1995. It also allows landlords to set market rates for new tenants when the current tenant vacates, a practice known as vacancy decontrol.

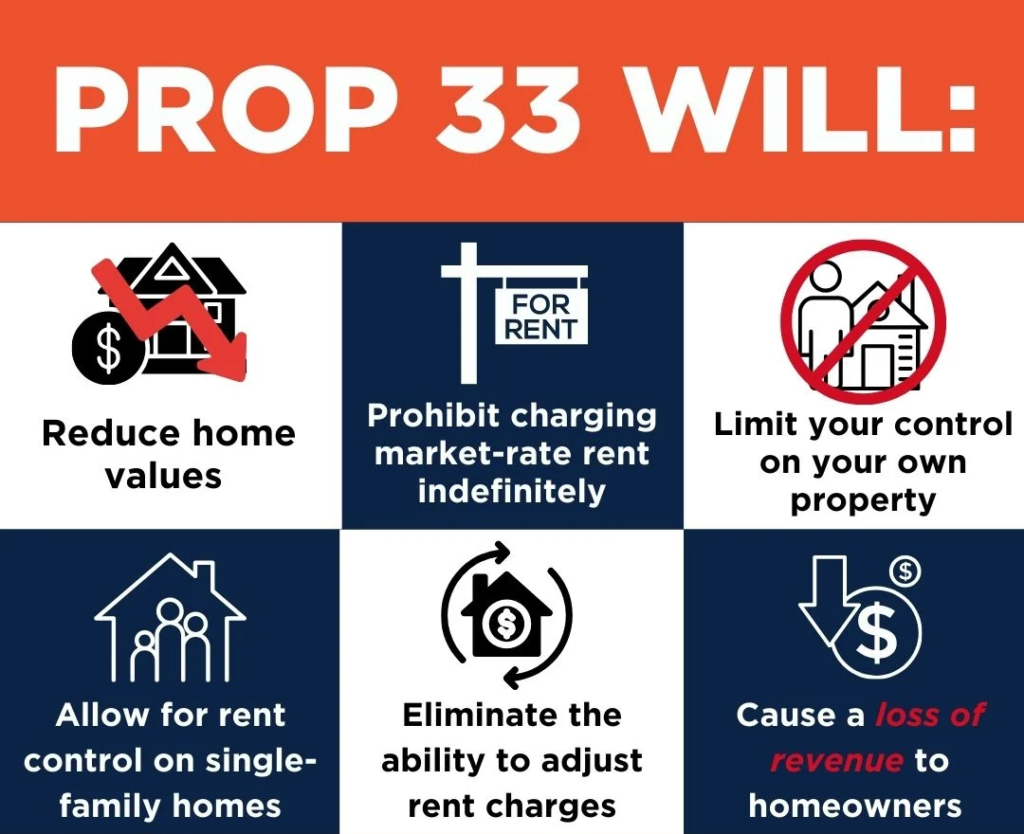

If passed, Prop. 33 would:

- Allow cities to apply rent control to any housing type, including single-family homes and new apartment buildings.

- Give local governments the power to limit rental increases for new tenants.

- Grant rent control boards broader authority over rental regulations, potentially leading to higher fees and stricter requirements for landlords.

What Are the Arguments for and Against Proposition 33?

Proponents of Prop. 33 argue that rent control is essential in addressing California’s housing affordability crisis. With nearly 30% of renters spending more than half their income on rent, tenant advocates believe this measure is a necessary tool for keeping rents affordable in high-demand areas like Newport Beach, San Francisco, and Los Angeles. Supporters claim that by expanding rent control, cities can help protect tenants from skyrocketing rental costs.

However, opponents point out that similar efforts to expand rent control have failed in the past, with 60% of California voters rejecting previous measures in 2018 and 2020. Critics argue that Prop. 33 could worsen the housing crisis by:

- Discouraging new housing development as investors shy away from building in areas with extreme rent control.

- Reducing the number of available rental units, as homeowners may exit the rental market altogether to avoid the added regulations.

- Decreasing property values, as rent control can lead to a lack of upkeep and necessary maintenance, ultimately reducing the quality of housing.

Economists from Harvard, Stanford, and the Rand Corporation agree that rent control often results in a loss of both housing and jobs, further exacerbating housing shortages. Additionally, the Legislative Analyst’s Office (LAO) has warned that expanding rent control could lead to higher rents due to reduced supply and increased demand.

How Will Prop. 33 Affect Property Owners?

For property owners in Newport Beach, Costa Mesa, and other high-demand areas, Prop. 33 could bring significant changes. One of the most contentious aspects of the proposition is the potential to impose rent control on single-family homes, which are currently exempt under Costa-Hawkins. If Prop. 33 passes, homeowners may lose the right to charge market rates for rental properties, even after a tenant vacates.

Moreover, this measure could allow rent control boards to impose additional fees and regulations on homeowners, further complicating the process of renting out properties. Many property owners may find that maintaining rental properties becomes financially unfeasible, leading them to either sell their properties or remove them from the rental market entirely.

What Does This Mean for the Housing Crisis?

California is already facing a significant housing shortage, and Prop. 33 could make matters worse. By discouraging new construction and limiting rental income potential for landlords, this measure may reduce the availability of rental properties in an already tight market. With an estimated 3.5 million homes needed by 2025 to meet demand, restricting the development of new housing is unlikely to solve the affordability issue.

Historically, cities with strict rent control policies—such as San Francisco and Los Angeles—also have some of the highest rents in the nation. This suggests that while rent control may provide short-term relief for some tenants, it ultimately creates long-term challenges for the housing market by reducing supply and driving up costs.

Conclusion: Navigating Prop. 33 with Confidence

As a property owner or landlord in Newport Beach, Costa Mesa, or coastal Orange County, it’s crucial to stay informed about the potential changes Prop. 33 could bring. Whether you’re concerned about the impact on your rental property or how this measure could affect home values in your community, understanding the implications is key to making informed decisions.

At Lucas Real Estate, we specialize in guiding property owners through the complex legal landscape of real estate. Our team has the expertise to help you navigate the ever-evolving regulations, ensuring that your investments remain protected. With years of experience in both real estate and property management, we are committed to providing personalized solutions that meet your unique needs. Whether it’s strategizing for new developments or navigating changes in rent control, we’re here to help you every step of the way.

If you have questions about Proposition 33 or need assistance with your property, don’t hesitate to reach out to us. We’re here to ensure that you remain well-informed and well-prepared in this dynamic real estate environment.

For more insights and professional real estate services in Newport Beach, Costa Mesa, and the coastal areas of Orange County, contact Lucas Real Estate today. Let us guide you through your next property transaction with confidence and clarity.

Contact us anytime via phone (949-478-1623) or email (info@lucas-real-estate.com)

Lucas Real Estate – Your Partner in Luxury Real Estate and Legal Guidance in Newport Beach and Coastal Orange County

– Devin Lucas

Author Devin R. Lucas is Real Estate Professional – a Real Estate Attorney, Broker and REALTOR® – specializing in Newport Beach, Costa Mesa and Orange County coastal communities, serving individuals and Trustees in residential real estate.

Lucas Real Estate – Attorney Devin Lucas and CPA Courtney Lucas – are experts in California Real Estate sales, capital gains issues and property tax matters including Propositions 13, 58, 193, 60, 90 and new Proposition 19.

To discuss selling your home:

info@lucas-real-estate.com | 949.478.1623 office | Or schedule a confidential no obligation call using this link

Legal or Tax Planing Questions? – Paid one-hour confidential legal consultations are conducted daily via Zoom and address virtually all questions, options, tax implications and strategies. (Book a consultation here.)

Sign up for our Newsletter here

Lucas Real Estate

REALTORS® and related Real Estate Law & Tax Considerations

Lucas Real Estate is a unique full-service residential real estate brokerage providing related residential real estate legal services and real estate tax considerations and planning, based in Newport Beach, California. | Devin Lucas is a licensed California Real Estate Attorney, Real Estate Broker and REALTOR® | Courtney Lucas is a California licensed CPA and REALTOR®

Check out our countless 5-star reviews and follow us on social media:

| Google Reviews | Yelp | LinkedIn | Zillow | Avvo | Facebook | Twitter | Instagram | YouTube | Official Site | Blog | Newsletter |

Sign up for our Newsletter here

lucas-real-estate.com | info@lucas-real-estate.com

949.478.1623 office

2901 West Coast Highway Suite 200

Newport Beach | California | 92663-4023

—-Disclaimer —- The content on this blog is for informational purposes only. Nothing on this blog should be construed to be legal advice, and you should not act or refrain from acting on the basis of any content on this blog without seeking appropriate legal advice regarding your particular situation, from an attorney licensed to practice law in your state. The content on this blog is not guaranteed to be correct, complete, or up to date. Devin R. Lucas’ office is in Newport Beach, California and is only licensed to practice law in California. Please be advised that Devin R. Lucas only provides legal services or advice pursuant to a written legal services agreement. The content on this blog is not intended to, and does not, create an attorney-client relationship between you and Devin R. Lucas, nor does our receipt of an email or other communication from you. Some jurisdictions may consider this site to constitute attorney advertising; accordingly, please be advised this is an advertisement.

IRS CIRCULAR 230 DISCLOSURE: To ensure compliance with requirements imposed by the IRS, we inform you that, to the extent this communication (or any attachment) addresses any tax matter, it was not written to be (and may not be) relied upon to (i) avoid tax-related penalties under the Internal Revenue Code, or (ii) promote, market or recommend to another party any transaction or matter addressed herein (or in any such attachment).