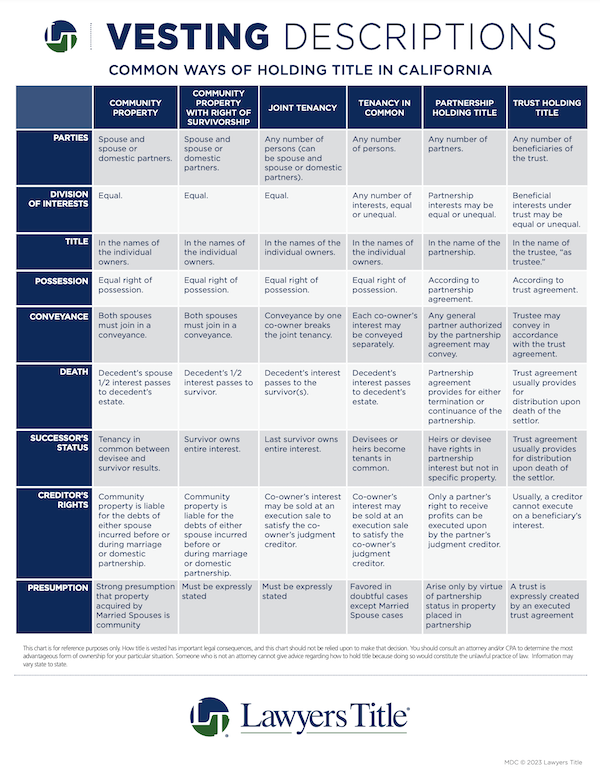

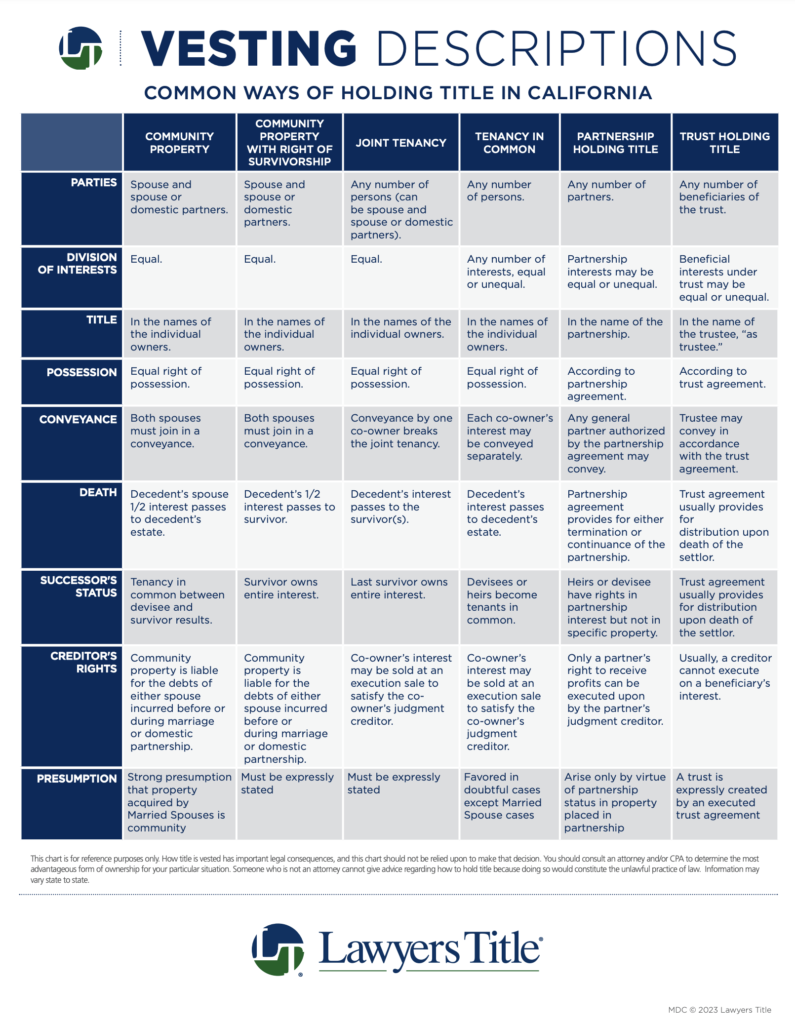

From our friends at Lawyer’s Title, a great infographic on the many ways to take title when buying real estate in Newport Beach, Costa Mesa or anywhere in the state of California. (other states likely have similar legal significance and state specific resources should be reviewed.)

How to take ownership of a property is very important and should be carefully considered, potentially with consideration from your attorney.

The form of ownership taken in the vesting of title will determine who may sign various documents involving the property, who may sell all or a portion of the property, what happens to a decedent’s share upon the death of a co-owner, and future rights of the parties to the transaction. These rights involve real property taxes, income taxes, inheritance and gift taxes, transferability of title, and exposure to creditor’s claims. Also, how title is vested can have significant probate implications in the event of death.

The below is for information purposes only from Lawyer’s Title.

(Full pdf version can be found at this link here)

– Devin Lucas

Author Devin R. Lucas is a Real Estate Attorney, Broker and REALTOR®, specializing in Newport Beach, Costa Mesa and Orange County coastal communities, serving individuals and Trustees in residential real estate, including leasing and select local property management.

Lucas Real Estate – Attorney Devin Lucas and CPA Courtney Lucas – are experts in California property tax matters including Propositions 13, 58, 193, 60, 90 and new Proposition 19.

To discuss selling your home:

info@lucas-real-estate.com | 949.478.1623 office | Or schedule a confidential no obligation call using this link

Legal or Tax Planing Questions? – Paid one-hour confidential legal consultations are conducted daily via Zoom and address virtually all questions, options, tax implications and strategies. (Book a consultation here.)

Sign up for our Newsletter here

Lucas Real Estate

REALTORS® and related Real Estate Law & Tax Considerations

Lucas Real Estate is a unique full-service residential real estate brokerage providing related residential real estate legal services and real estate tax considerations and planning, based in Newport Beach, California. | Devin Lucas is a licensed California Real Estate Attorney, Real Estate Broker and REALTOR® | Courtney Lucas is a California licensed CPA and REALTOR®

Check out our countless 5-star reviews and follow us on social media:

| Google Reviews | Yelp | LinkedIn | Zillow | Avvo | Facebook | Twitter | Instagram | YouTube | Official Site | Blog | Newsletter |

Sign up for our Newsletter here

lucas-real-estate.com | info@lucas-real-estate.com

949.478.1623 office

2901 West Coast Highway Suite 200

Newport Beach | California | 92663-4023

—-Disclaimer —- The content on this blog is for informational purposes only. Nothing on this blog should be construed to be legal advice, and you should not act or refrain from acting on the basis of any content on this blog without seeking appropriate legal advice regarding your particular situation, from an attorney licensed to practice law in your state. The content on this blog is not guaranteed to be correct, complete, or up to date. Devin R. Lucas’ office is in Newport Beach, California and is only licensed to practice law in California. Please be advised that Devin R. Lucas only provides legal services or advice pursuant to a written legal services agreement. The content on this blog is not intended to, and does not, create an attorney-client relationship between you and Devin R. Lucas, nor does our receipt of an email or other communication from you. Some jurisdictions may consider this site to constitute attorney advertising; accordingly, please be advised this is an advertisement.

IRS CIRCULAR 230 DISCLOSURE: To ensure compliance with requirements imposed by the IRS, we inform you that, to the extent this communication (or any attachment) addresses any tax matter, it was not written to be (and may not be) relied upon to (i) avoid tax-related penalties under the Internal Revenue Code, or (ii) promote, market or recommend to another party any transaction or matter addressed herein (or in any such attachment).